U.S. Sublease Office Space Soars in Third Quarter, to Near 2009 Peak

National Real Estate Investor, Dec. 17, 2020

By Patricia Kirk

Driven by a combination of continued remote working, workforce reduction and economic uncertainty, it’s not surprising that 80 percent of markets tracked by real estate services firm Transwestern have reported an increase in sublet office space in recent months.

“Nationally, the sublease availability rate is 0.9 percent or 163 million sq. ft., as of third quarter 2020, which is comparable to the 0.8 percent (of total available inventory) or at 137 million sq. ft. reached during the 2009 recession,” notes Elizabeth Norton, senior managing director of research services with Transwestern.

It’s no secret that energy-related companies and law firms are marketing large amounts of sublet space and negotiating with landlords to give back space or downsize during lease renewals, as both industries have significantly downsized staff.

Sherry Cushman, vice chair of Cushman & Wakefield’s legal sector advisory group, says that the group’s survey of 608 law firms found that those firms had laid-off 15 to 20 percent of attorneys and support staff since the pandemic began and are now focused on maintaining profitability through streamlining services.

Meanwhile, the Houston Chronicle reports that more than 100,000 U.S. oil and gas workers have lost their jobs over the last year due to the oil price meltdown and decline in demand for gas during the pandemic.

According to the third quarter report on Houston’s office market from real estate services firm CBRE, the amount of sublease space in the city has slowly risen over the last two quarters, but was still under 6.0 million sq. ft., representing 10.2 percent of total availability and 2.6 percent of existing inventory.

While this was far from the peak of sublease availability in 2016, when sublease space topped 11.0 million sq. ft. and accounted for more than 25 percent of total available space, Houston was hit this year with a “double whammy”: the pandemic and the oil price crisis. Nearly two-thirds of this market’s available sublease space is in class-A properties and more than two-thirds of this space is located in Houston’s central business district (CBD), Energy Corridor and West Loop/Galleria submarkets.

Nationwide, there has been a 33 percent increase in post-pandemic sublet space throughout the third quarter, according to Sarah Dreyer, vice president and head of America’s research for real estate brokerage and advisory firm Savills. She expects available sublease space to surpass 2009 levels by the end of the year.

Dreyer notes, for example, that New York, the biggest U.S. office market, is already approaching the 16.3 million-sq.-ft. peak in available sublease space reached in 2009, with 16.1 million sq. ft. available at the end of third quarter. New York experienced a 46.8 percent increase in sublease space post-pandemic through the third quarter, while direct available space increased by just 13.7 percent over the same period. The city’s sublease space represented 26.7 percent of total available space at the end of the third quarter, according to a Savills report, with 37 new blocks of space exceeding 50,000 sq. ft. added to the market.

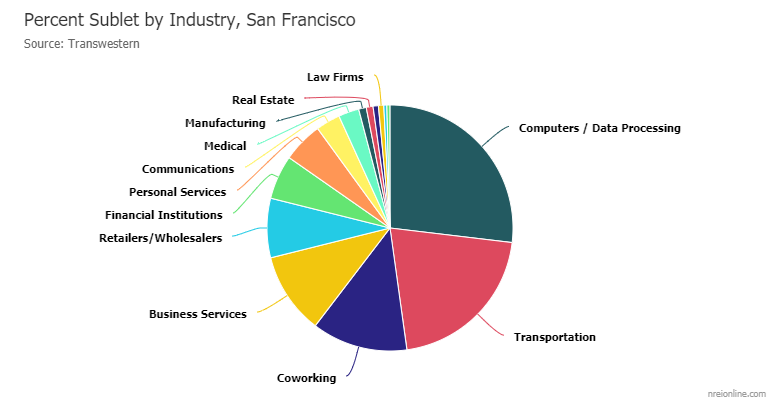

“New York has a lot of sublease space, but not the greatest increase in sublet space,” Dreyer notes, however. San Francisco’s sublet space is on track to triple, rising by up to 148 percent. Norton notes that San Francisco’s sublease space, at nearly 7.4 million sq. ft., represented 8.7 percent of the market’s total 84.7 million sq. ft. of office inventory at the end of third quarter and 42.3 percent of available office space.

Buildings with blocks of sublease space exceeding 100,000 sq. ft. in San Francisco, include: 1455 Market St., 680 Folsom St., 555 Market St., 685 Market St., 1800 Owens St., Pier 70 and 760 Market St., according to Transwestern data.

In addition, Phoenix, New Orleans and Austin, Texas saw their available sublease space more than double, while the availability of sublease space in Chicago, Dallas and Charlotte and Raleigh, N.C. increased by more than 50 percent.

The most resilient markets during the pandemic, according to Dreyer, include the Washington-Baltimore region, which is bolstered by government and government-related tenants, and less dense markets like Atlanta and Tampa, Fla., which are less dependent on mass transit.

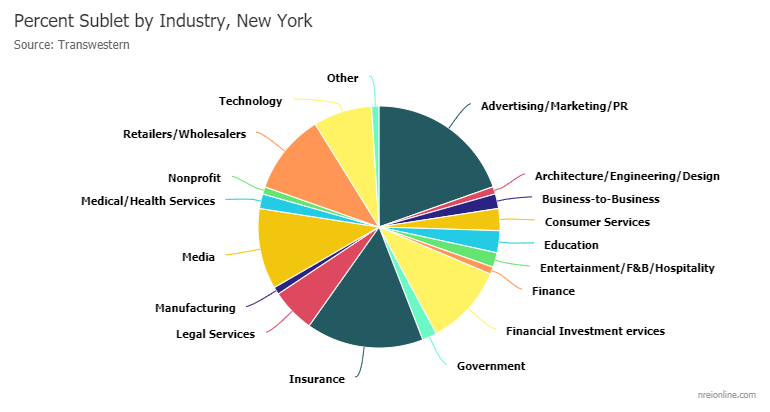

The type of tenants subletting unneeded office space depends on a market’s core economic sectors. In Manhattan, for example, the majority of office sublet space placed on the market in the second and third quarters was by tenants in the TAMI (tech, advertising, media, information) sectors (47.7 percent) and financial services and insurance sectors (19.2 percent), followed by legal services (15.4 percent) and retailers and luxury brands (10.4 percent), according to Savills.

As a result, tenants looking for new office digs are currently able to score very competitive deals, whether they choose sublease or direct space. In Manhattan, for example, the average direct asking rent in the third quarter was $84.43 per sq. ft., while sublease asking rent was $65.39 per sq. ft. In Tampa, direct asking rents averaged $26.48 per sq. ft. and sublease asking rents averaged $23.71 per sq. ft.

And while landlords are taking a wait-and-see approach to lowering rents on direct space, concessions have increased by 10 percent on average, according to Dreyer—more in some markets—and include free rent and generous tenant buildout allowances for long-term leases.

Despite available bargains, however, leasing activity has been next to nothing, as most tenants are taking a “pandemic pause” for making real estate decisions until life returns to a more normal mode, she says.

Only 33 percent of markets tracked by Transwestern posted positive net absorption during the 12 months ending September 2020, with Seattle leading due to the presence of tech giants in the city: Microsoft, Google and Amazon. The third quarter, however, saw a major drop in leasing activity, with only four markets posting positive absorption.

The Pandemic Didn’t Stop Venture Capital From Flowing Into Houston’s Life Sciences Sector This Year

Bisnow, Dec. 17, 2020

“They’re all having a problem with growth. I think our biggest issue is that we don’t have enough supply for them,” Transwestern Executive Managing Director, National Healthcare Advisory Services Eric Johnson said…

Offices Spreading Holiday Cheer, Even If You’re Not There

Propmodo, Dec. 16, 2020

“For most of our clients, the budget has not changed and the need for holiday cheer has never been greater,” Transwestern Senior Vice President Asset Services, Midwest Region, Micah Larmie said…

The “New Normal” For Office Space is More Familiar Than We Think

D Magazine, Dec. 6, 2020

The re-evaluation of office space, and the importance of the workspace, has been something the business world has never seen to the extent it has this year…

Fredrikson & Byron Leases 178,000 Square Feet at KBS’ 40-Story Class A Office Tower in Downtown Minneapolis, Minnesota

Associated Press, Dec. 22, 2020

Brent Robertson, Andrea Leon and Jon Dahl of JLL represented KBS in the lease transaction, while Mike Salmen, Larry Serota and Will McDonald of Transwestern…